We Have Entered the Climate Decade

A long boom of climate tech is just getting started

Andrew Beebe |

As we finally put 2020 into hindsight, the road ahead is uncertain. On the one hand, stock markets continue to thrive, and the economy feels poised to come roaring back, fueled by a population vaccinated and ready to work and play with others again. On the other hand, many worry which bull markets might stumble, and which bubbles might burst.

Beyond the legitimate handwringing, there’s one economy that will provide steady, consistent opportunities and growth in the coming decade: The Decarbonization Economy. Call this ClimateTech, Cleantech 2.0, or something new, but know this about the transition to an economy free of carbon emissions: it’s big, it’s getting bigger, and it won’t be going away. This new economy is different. We’re not shoehorning sustainability into old systems. We’re redesigning the economy. The scale of this transformation is on par with the digitization economy before it.

Andrew, you say, give me a break. We’ve seen this movie before— in fact, I think you were in this movie. The Cleantech 1.0 “revolution” turned out to be a dud. The promises were massive, and the results were not. Aren’t you just setting us up to repeat history? Can’t we learn from the past?

The decarbonization of the global economy is a transformation on par with the digitization of the economy before it.

We can learn from the past—and we are soon to learn that this time is different. As with many transformations, the visions laid out over a decade ago were powerful, but not ready to scale. Renewable generation was too expensive, batteries weren’t ready to power our vehicles, and much of the world had not felt the sting of climate change. We did the work, but it certainly took longer than we all wanted.

2000–2021, In Brief

When I started my journey as a founder in the cleantech world in 2003, “climate change” was a thermostat setting. Al Gore’s documentary An Inconvenient Truth was three years from release, and oil was at historic low pricing. What a difference a decade (or two) makes. By 2010, climate was moving up the ladder of “most important” issues on polls, solar was much cheaper, and proof points of climate-related start-ups were starting to appear—including Tesla, Sunrun, Nextracker, and Nest, which helped reimagine that thermostat.

But it wasn’t enough. We didn’t “solve” the existential crisis of climate overnight, and we didn’t create a new fusion device with infinite carbon-free power. Investors used venture dollars for project finance, and mainstream venture just plain missed some of the big winners from FirstSolar to Chinese solar start-ups. So, the attention of tech founders focused elsewhere. All but a resolute few went back to that other transformation of our economy, digitization…and decarbonization was a side-effect, at best (see Zoom).

Fast forward another decade, and we’re back. Early-stage founders, funders, and change-makers are uniting in their commitment to making it work.

But why is this time different? This time is so much broader—we’re talking about all aspects of climate and our economy, not just energy. But beyond that, there are specific drivers of change this time around.

Today: Five Key Differences

What clear signals make me confident in our ability to create massive value while transforming our global economy, and why today? Here’s my top five.

1. Corporate and Consumer Demand Both Go Clean

There’s a perfect storm today of consumers, investors, and corporations all pushing in the same direction. Large multinationals are tripping over each other in an effort to become the leaders in speed (“Carbon Neutral by 2030!”) or depth (“Carbon Negative by 2030!”). These are not pie-in-the-sky, free-of-charge goals. These ambitions cost money, and take time and focus. Compared to the last go-around, these companies are now tooling up and learning from the past. They have met some of those early goals (see: Google), and know what it takes. Expect to see more mention of “100%” and “Net Neutral” in the coming years. These labels will apply to energy, but also water, agriculture, and mobility. Corporate board rooms are already boning up on the differences between scope 1, scope 2, and scope 3 emissions because they know the next generation of customers will demand they get it (see #4).

Consumers are also behaving differently this time around. Whereas before climate change was more in the movies than a lived experience, today they see it—and are increasingly living it—year round. The fact that Californians talk about “fire season” now like it’s just part of the calendar is the tip of the melting iceberg. According to one survey, 93% of executives believe customers hold them accountable for their environmental impact.

The availability of transparent information plays a role here as well. Younger generations leading today’s buying power use the internet to clearly understand their ingredient labels—not just for what they put in their bodies, but what they put on their bodies, feed their pets, and use to build (and clean) their homes. They are coming to expect that those ingredient labels also help them understand their carbon and environmental impact.

2. Cost and Performance

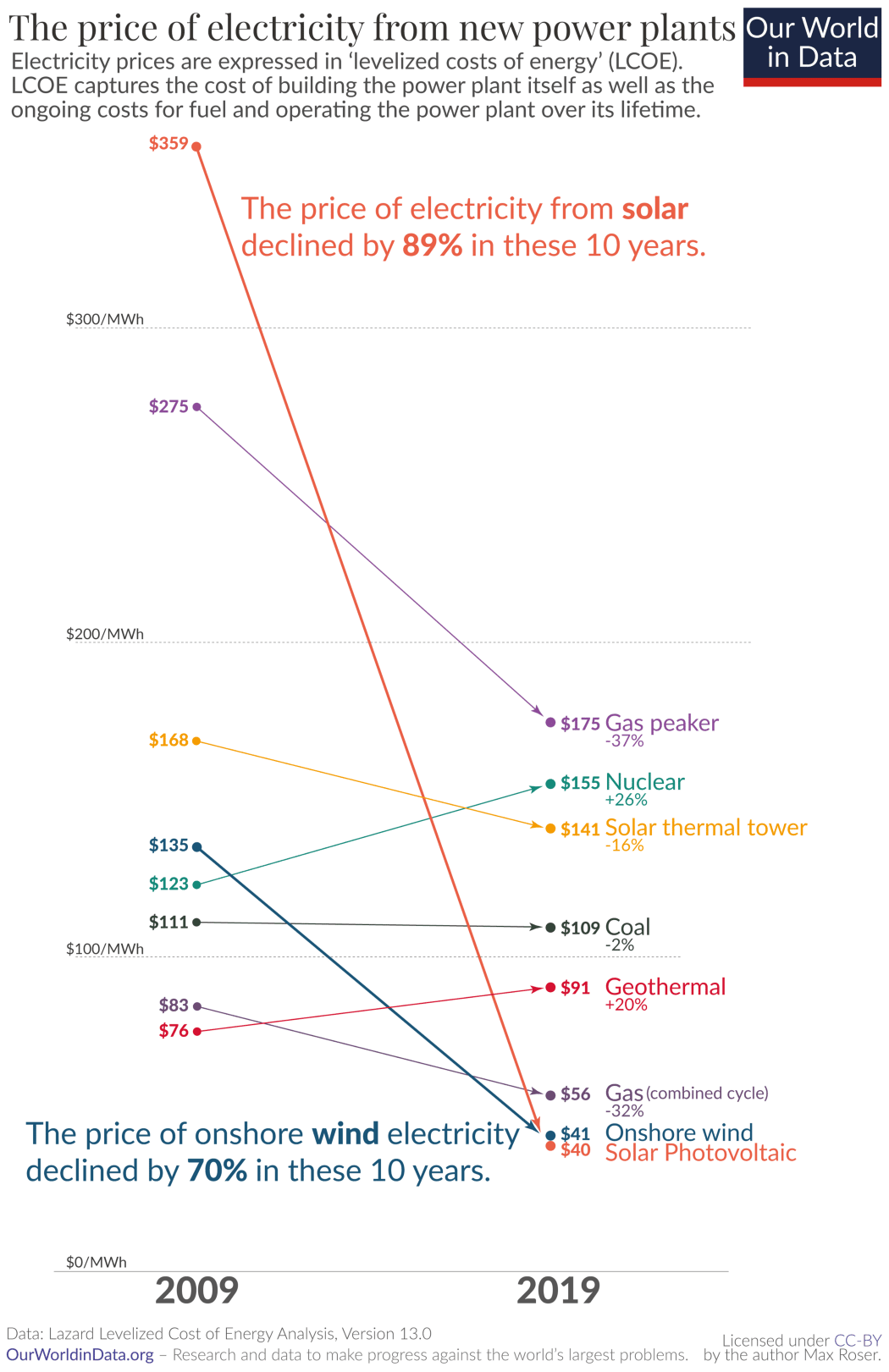

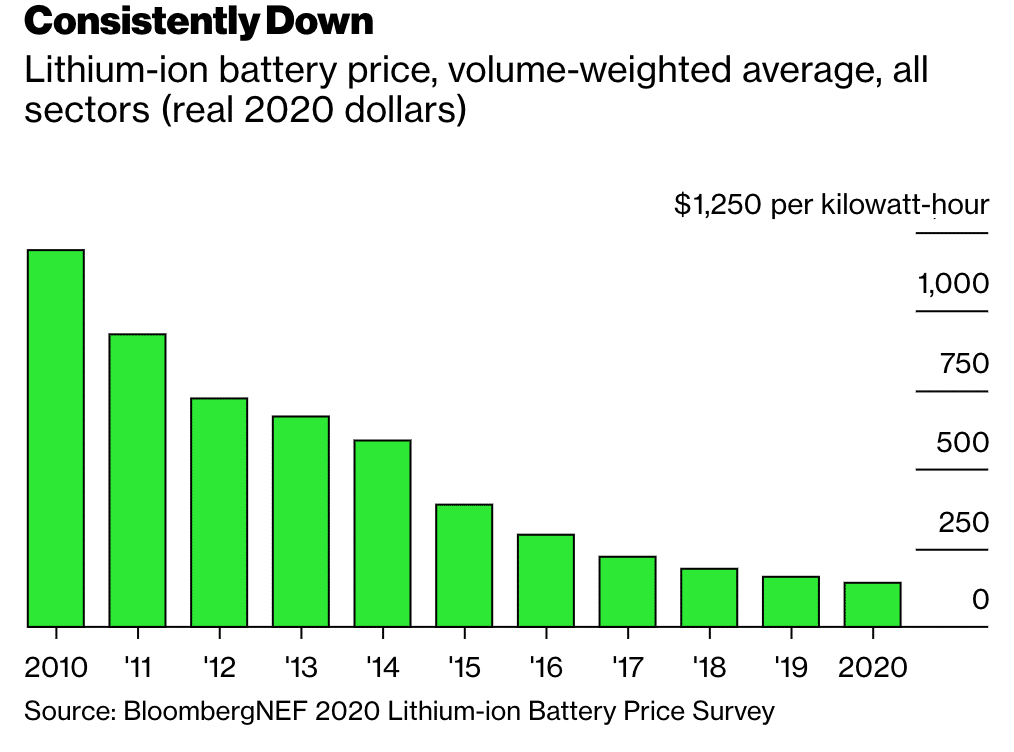

Today, evidence is everywhere that we are in the midst of a complete transformation of carbon-producing economies. Solar costs have dropped by 90% in the last decade alone (and 90% in the decade before that). Wind energy is now cost competitive in most parts of the world. Batteries are powering some of the most popular passenger cars ever made. It took us two decades to get to this point, but the better way is now also the more economical way.

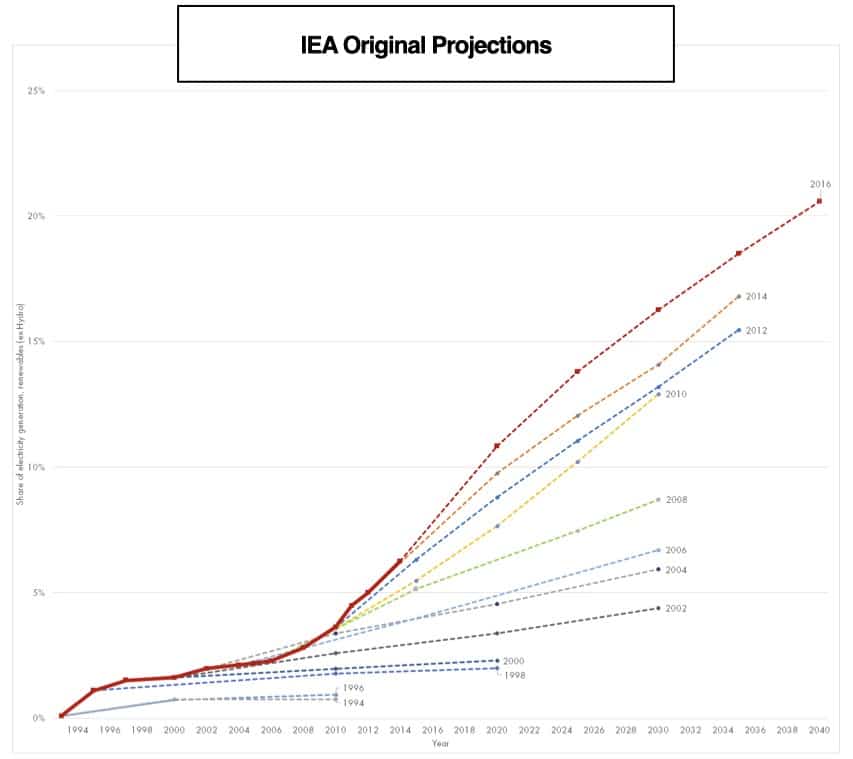

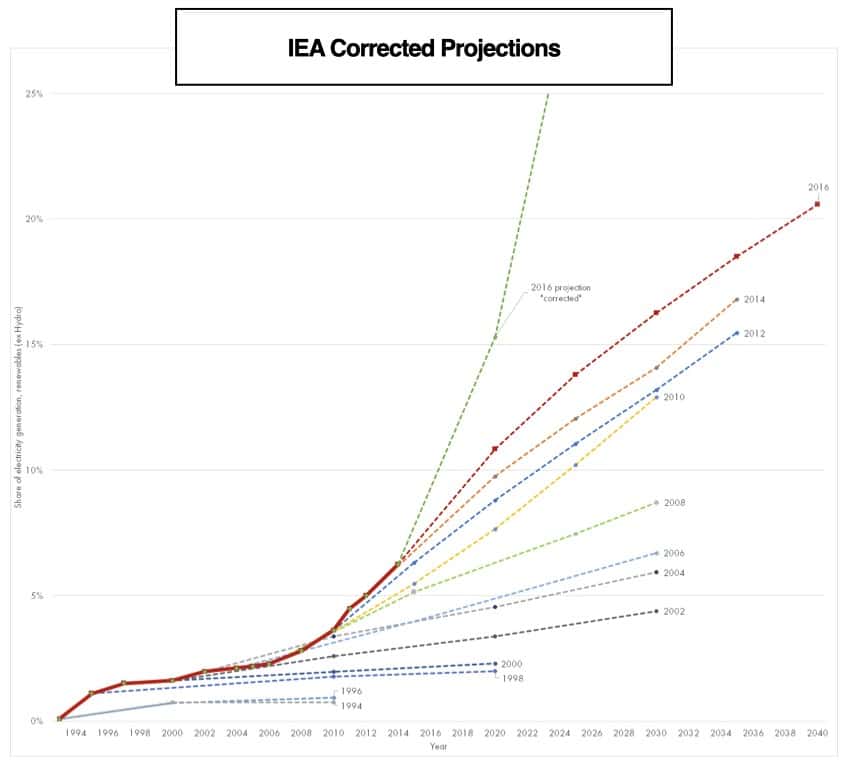

What’s even more exciting is that, if history is any guide, we’re still radically underestimating what’s ahead:

These charts take a minute to digest, but it’s worth the effort. Solar and wind cost estimates from the IEA have been so far off for so long, it’s staggering. Luckily, there are better sources.

If these trends continue to be this far off not only for clean energy, but also for energy storage, things are about to get interesting. With solar, wind, and energy storage as the only obvious choices for generation and land-based mobility, it appears we are at the beginning of radical disruption.

3. Follow the Money

While scientists and industry insiders have seen this wave coming for some time, the money has now definitively entered the building. Unlike last time around, this isn’t about loan guarantees or DARPA grants (though they’re there too), it’s about every layer of the capital stack. One need look no further than Tesla’s stock price to see the demand on the electric vehicle (EV) front. Proterra, our first investment in the EV space over four years ago, announced a SPAC last week, and shared revenue forecasts in the many hundreds of millions. The SPACfest now in full swing around EVs and energy storage is next up. The retail investor demand for future-proof, anti-fragile tech and business models is clear.

Below that, the private money is also showing up. An increasing number of LPs, family offices, and institutional investors understand this transition is happening, and is where alpha returns will be derived. With TPG, KKR, Wellington, Breakthrough Energy Ventures, Union Square Ventures, Fifth Wall, EIP, Congruent, G2VP, Prelude, DBL, Techstars, Moxxie and many more, the list of climate-focused funds (and their fund sizes) is growing rapidly. Of course, corporates are getting in the game as well. You can expect to see all of the Oil Majors convert to “Energy Majors” as many in Europe have already done. Even Amazon and Microsoft are all in. Also critical is the vibrant ecosystem of seed and early-stage investors like Chris Sacca’s Lowercarbon Capital, Matt and Taj at LACI, Emily at Powerhouse Ventures, Sundeep at Climate Capital, Dawn at Elemental Excelerator, Seth and Ela at 50Years, Josh (of Freestyle fame) and Jason of My Climate Journey. Great angels like Sierra Peterson, Tommy Leep and Pietro Invernizzi (now at Stride) are also working hard to move the conversation forward.

4. The Next Generation

In addition to demanding clarity on the impact of their purchases, Millennials and Gen Z also want to find impact in their work. According to one survey, 70% of Millennials are more likely to join companies strong in sustainability. This conviction in livelihood and purchasing intent seems only to increase with younger survey respondents—and there is no evidence whatsoever that it will slow down. As we’ve seen in recent elections the world around, the climate issue polls higher and higher with every new cycle. We also see a clear push to do this in a more diverse, inclusive and equitable way. Leadership at the grassroots level is everywhere (see Edict, VCFamilia, Browning the Green Space, GreenTech Noir, Earth in Color).

5. Policy and Regulation

Consumer behavior and corporate response act as a virtuous cycle of improvement for these industries. That’s the carrot, but there are sticks as well. Governments around the world have offered varying levels of support and pressure in this transition. Chinese mandates, European subsidies, and even the U.S.’s distributed (state-level) efforts—all point to a world clearly moving in the same direction: fewer emissions, and fast. Let’s face it: fearless, consistent leaders like Fran Pavley, David Hochschild and Mary Nichols stepped up in California for much of the nation (and at times for Tesla), while others at the federal level walked.

While the U.S. movement has relied heavily on state-level efforts to date, there’s real reason to believe that this new administration, coupled with many Republicans who want to support climate action now, will be aggressively playing catch up in the coming years. Even the Federal Reserve and the National Economic Council are getting in on the game. Regardless, companies, consumers, and investors agree that government is likely only to be more supportive of climate mitigation efforts.

The “Low Maslow” Land of Opportunity

When Amazon launched in 1994, it was called Amazon.com because they needed to help people understand where to find them. This bookstore had no retail outlet, and that was confusing to consumers. In 2012, 18 years after its founding, the company finally dropped the “.com.” It took nearly 20 years for the phrase “dot-com company” to become redundant.

Similarly, over the next 20 years we’ll see concepts like “renewable energy company”, “electric vehicle company” and “sustainable supply chain” all become redundant.

These wholesale industry transformations will be made by startups reimagining trillion-dollar sectors, many of which form the basic building blocks of society today like transportation, housing, supply chain, and more.

Mobility: Everything Electric

Five years ago, Obvious put a stake in the ground around the coming electrification of everything. Soon after, we made investments in electric ground transportation, heavy duty EVs, and electric flight. Most recently, we invested in electric vehicle fleet management. When it comes to the transformation of transportation, we’re just getting started.

There is now a “Tesla Mafia” of former leaders from within the EV maker who have moved on to build out what could become an EV-native tier one and tier two supplier network for this revolution. From Gene Berdichevsky at Sila Nanotech to Dustin Grace at Proterra and Anil Paryani at AMP, the list is long.

Key areas in electrification that are ripe for investment include, along with some sample companies:

- Non-road solutions (yard/port systems, rail, marine, air) including the likes of Moxion, Ampaire, ZeeAreo, Wright Electric, Parallel, Intramotev, and Lilium.

- Connected vehicle solutions (including over-the-air updates, vehicle to infrastructure and vehicle to grid) with examples including AMP, Amply, and EVConnect.

- Everything battery (additives for lithium batteries, new designs, BMS software and recycling) with players like Zenlabs, Qnovo, Sila, Advano, and Stem.

The (De)Carbon Economy

In the cleantech 1.0 era, there was a strong belief in carbon trading as a way to kick our carbon addiction. Credit trading for acid rain and other pollutants had worked well, and so why not this? But the foundational systems were far from ready to support commercial rollouts. What’s a “carbon credit” anyway? How much carbon does our company use? How do we certify these mechanisms?

This time around, the plumbing has been built out, government solutions have been established, and companies are jumping on board. Areas of opportunities, along with some sample companies:

- Enterprise-grade carbon accounting with Emitwise, Sinai, Plan A, Watershed, and Persefoni.

- Robust and automated carbon trading platforms (possibly using distributed ledger technology) like Pachama, Nori, and Silviaterra.

- API-level carbon commerce integration (why doesn’t Amazon just know how much it might cost for me to offset the entire purchase…and then offer to charge me…or do it for me?) with Patch and Cloverly.

Building Better (Buildings)

Construction Tech has been a contradiction in terms for decades. As the data prove, cost effectiveness (or lack thereof) in construction is one casualty of a lack of technology. That’s changing, and we’re excited to be part of it. Building better means more efficiently, safely, and sustainably. Obvious has invested in sustainable prefab with Plant; safe, fast, and sustainable construction with Canvas; and new ways of work for the industry with Block and RenoRun.

The next phase of cleaner, greener, and healthier building will be lead with areas like:

- More robotic construction in the market with the likes of Canvas, Built, and Plant.

- Digital twins for buildings, not just in design and construction, but also in operations (see: Avvir and Doxel).

- Buildings becoming integrated assets within a distributed grid, powered by companies including Blueprint Power, Bloc Power, and Carbon Lighthouse.

Supply Chain → Sustainable Supply Cloud

Few sectors of the economy experienced fragility last year quite like the global supply chain. Between pandemic impacts, trade wars, and demands for more sustainable sourcing, the challenges were massive in the midst of a huge spike in demand. We believe a large part of the solution will be empowered by digitizing more of the industry to become a cloud, not a chain. Investable areas abound here:

- Sourcing transparency across industries, producing “ingredient labels” which can help with carbon impacts, chemistry content, and upstream production practices with CarbonChain, Supplyshift, Madefrom, and CarbonCloud.

- Logistics efficiency plays in shipping, trucking, and last mile solutions with the likes of SmartHop, Leaf Logistics, Flowspace, and Shipium.

- B2B vertical marketplaces focused on digitizing what is today often a very offline and inefficient system, including players like Waybridge, Mable, and Mickey.

The Macro Cycle Becomes the Structural

But wait—economies are cyclical. Why would this be any different? Why are you calling this a long-boom? Like all industries, there are cycles—but there are also synchronous, structural shifts that can accompany them.

And structurally speaking, this is a one-way street.

We won’t be longing for the days of coal-fired power plants, waste-filled supply chain processes, and oil-burning combustion engines ever again (not that we ever truly longed for them in the first place). I’ve never met anyone who said, “You know, I love doing things more expensively, more wastefully, and more dangerously than we have the ability to do now.”

I’ve seen the passion in founders, funders and big company execs: Once you “go climate” you don’t go back.

There’s Room On the (Electric) Bus

Let’s get it right this time. Cleantech 1.0 was a great effort, but overexuberance got the better of us, particularly on the investor side. Let’s work together to move thoughtfully, sharing knowledge and scaling businesses prudently.

At Obvious, we believe more strongly than ever that the most successful companies of our time—as measured by both market share and the moral compass that steers them—will be transforming entire sectors of the global economy in world positive ways. Addressing the great climate challenge before us will take entrepreneurs of all stripes building purpose-led enterprises across a multitude industries, just a few of which are mentioned above.

If that’s you, I’d love to hear from you on Twitter (@andrewbeebe) or at a@obviousventures.com.