Fixing the Fickle Finances of Healthcare

How entrepreneurs are helping consumers get better-priced, higher-quality care—with more opportunities ahead

Kahini Shah |

In early May, my fingers began feeling uncomfortably sensitive and my wrists hurt. I wasn’t sure if it was carpal tunnel (CTS), a neurologic issue, another muscular problem, or something else entirely. I wanted to fix it, but couldn’t figure out what type of doctor or therapist to see. The least expensive and quickest path to resolution, I thought, would be a telemedicine appointment with One Medical.

I booked it, received a CTS diagnosis, and a treatment plan including NSAIDs, wrist braces, and not using my hands.

It didn’t work.

Four weeks later, the bill arrived with a dose of sticker shock: $520. Was it incorrectly coded? Insurance issue, as I’d recently joined Obvious Ventures? I had already scheduled a follow-up visit, and had I known about the first visit’s cost, would not have gone back.

I’m still working to decipher it all.

My recent story is part of a broader problem millions of Americans are well aware of: expensive care with suboptimal outcomes. In 2020, U.S. consumers and businesses spent over $1 trillion on private health insurance premiums, with consumers on the hook for an additional $400 billion on out-of-pocket costs for healthcare*. While these declined somewhat during the pandemic, year-over-year increases have outstripped inflation. These give the U.S. the highest per capita cost of care in the world.*

Despite collectively paying a fortune, an individual’s journey to obtain quality, affordable care in the United States is fraught at every step. Consumers’ experience (at least for those with employer-sponsored coverage, or no insurance) in healthcare can be as much financial, if not more, as it is medical. For 32% of Americans unable to cover a $400 expense*, a $520 bill would immediately throw them into debt.

It’s a broken process which I’ve broken down across four stages, with color on where it can be improved and some of the stellar startups making it happen.

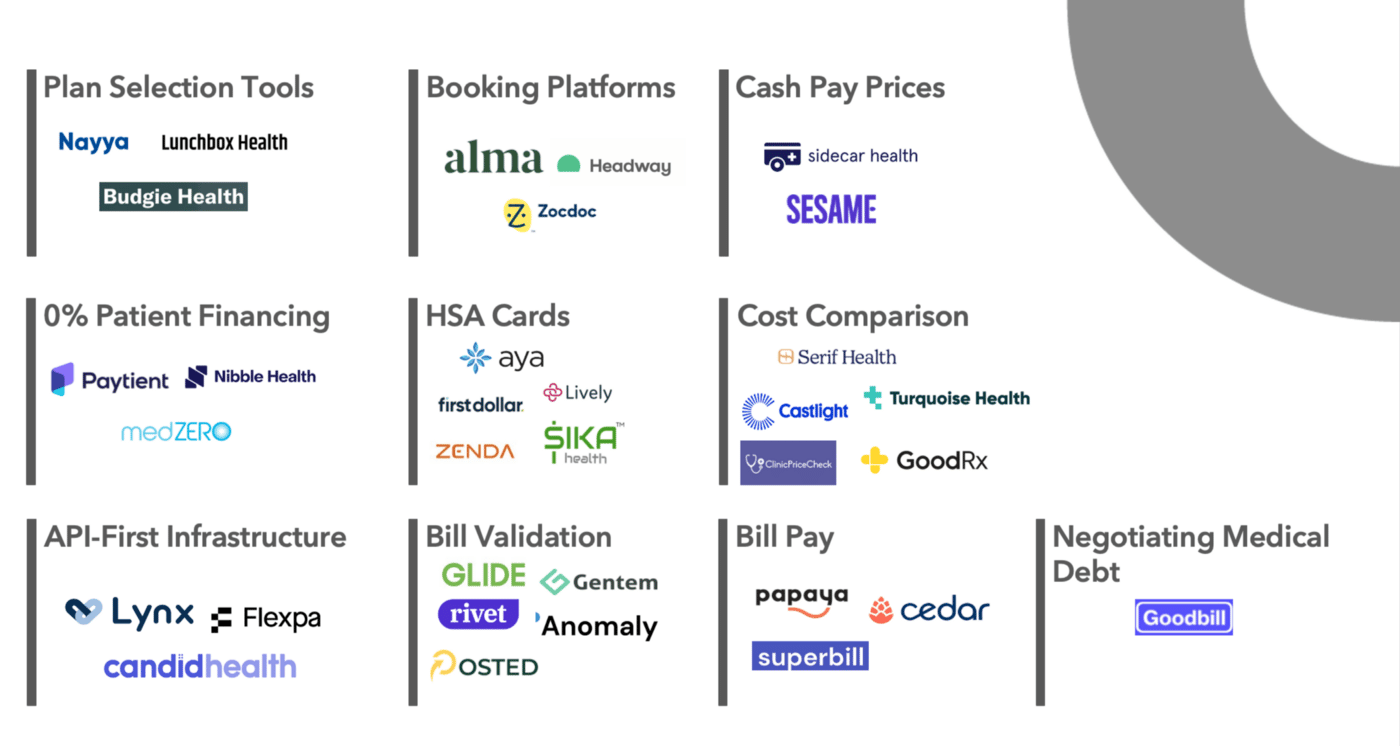

Stage 0: Picking a Plan

Every year, Americans with employer-sponsored coverage choose their insurance during open enrollment season where they can choose from a host of options. Those without sponsored plans check offerings offered directly from insurance providers, seek coverage options on the exchanges, or neither. Even opting out of health insurance coverage is a choice. Employers can contract with companies like Nayya and Budgie Health that offer plan selection tools.

Stage 1: Finding a Provider

While this stage doesn’t incur any direct costs, consumers must make critical decisions without all the facts—and the wrong choice can inhibit the healing process and result in higher costs. In this stage, consumers ask two key questions: (1) Who can provide high quality care, and (2) how much will this cost? There is no singular, integrated solution that can help, but there are point solutions:

- Booking Platforms: If consumers don’t have a provider in mind, certain platforms allow consumers to discover and schedule with a provider. Zocdoc factors in consumers insurance for their recommendation, while Headway and Alma have businesses in the mental health vertical for discovering in-network providers.

- Cash Pay Prices: For consumers lacking insurance, knowing the cash price of care can help their decision-making. Sidecar Health analyzes and aggregates a variety of sources to calculate the average cash price for every procedure, test, and drug in the U.S. health system and makes them accessible to consumers for a premium. Sesame is another option for individuals without insurance or with high deductible plans, through a marketplace model that provides access to care at flat rate prices. As an added bonus, cash pay prices can be lower than insurance-negotiated prices.

- Cost Comparison: The percentage of Americans on high deductible plans is increasing, and for those individuals where cost of care is a high priority, checking prices before appointments is critical. Castlight was ahead of its time when they launched a price comparison tool over a decade ago. GoodRx built a thriving business providing cost comparison for medications, and their proprietary pricing algorithm has normalized 150 billion prescription pricing data points.

New price transparency regulations* mandate that hospitals provide clear, accessible pricing information about the items and services they provide. Companies like Turquoise Health aggregate pricing data from hospital websites, and have designed a UX making the information consumable by people, providers, and payors. Turquoise Health recently announced a partnership with Ribbon Health* that can pull in quality data as well to help consumers make more informed decisions.

Stage 2: Seeing a Provider

Billing in the United States is determined by Current Procedural Terminology (CPT) Codes. These codes are based on the reported care provided during the visit. The provider creates a claim that goes through a process called adjudication, where a clearing house determines how much the provider gets paid and how much the consumer and insurer owe. The output of this process is used to generate a bill that the consumer receives. While an estimate should be knowable beforehand based on negotiated contracts, claim adjudication can take weeks—a process difficult for consumers to understand the results of, and often riddled with errors.

- Bill Validation: Groups that review medical bills on behalf of patients estimate that 75%+ contain an error *. Startups that help validate claims that are the basis of bills, are closely tied to the revenue cycle management (RCM). They validate and can use machine learning to determine the CPT codes, depending on the incentives, sometimes the CPT codes selected are the ones that benefit providers most. Despite this issue, it is still a step towards decreasing errors and reducing processing time.

- Billing and Payment: Medical bills can be confusing and paying them can be high friction since they are often mailed. Depending on the practice, paying might require writing checks or creating accounts on websites with bad UIs. Papaya Payments makes it easier to pay any medical bill by taking a picture of it (they also do parking tickets)—it’s one of my favorite apps! Superbill, a new company, makes it easy to file claims for out-of-pocket reimbursement.

- API-First Infrastructure: This is a category that I’m excited about—it brings the developer first ethos that transformed enterprise, commerce and fintech. It allows providers to power modern experiences for consumers. Lynx, an Obvious Ventures portfolio company, does fintech-as-a-service for healthcare, embedding payments, banking, e-commerce, and investments directly into any consumer experience such as an HSA account. Candid Health provides billing infrastructure to help providers streamline the billing process. Flexpa is building the “Plaid of healthcare” by connecting health plans, claims, and clinical data. In addition to medical workflows, Flexpa unlocks financial workflows like checking coverage or grabbing explanations of benefits.

Stage 3: Paying For It

Now we’re finally at the phase where money exchanges hands. If there are no errors or surprises and the consumer can afford to pay via cash or HSA/FSA—great! If not there are tools that might be available to help consumers understand, pay, and/or dispute bills.

- HSA Cards: HSAs provide the ultimate tax advantage—the money is deposited before tax, then can be invested at a person’s discretion (depending on plan), while withdrawals for eligible spend are not taxed. New companies are trying to add value by helping consumers save, invest, and optimize spending while on high deductible plans. A few players include First Dollar, Lively, Zenda, Aya, and Sika Health.

- 0% Patient Financing: Sponsored by employee benefit plans and collateralized by future potential earnings, these solutions offer lending at no cost to employees/consumers so they can get the care they need. There are three great players in this market and what separates them from other BNPL solutions is that they do not charge the consumer high APRs, ever.

- Negotiating Medical Debt: Over one-third of U.S. adults has medical debt*, which itself causes 67% of the bankruptcies stateside.* I’m encouraged by new regulations such as the Surprise Bill Act*, which restricts sticking patients with unexpectedly large bills. While the final form of this rule is not clear, it outlines a dispute resolution process, good faith upfront estimates, and an appeals process for health plan decisions. Combined with the Price Transparency rule that provides an actual basis for prices, companies like Goodbill are armed with the tools necessary to help consumers dispute unjust charges.

I’m excited by the progress we’ve made in helping consumers navigate the financial aspect of healthcare through the use of data and technology, and pleasantly surprised by the pro-consumer regulations such as the Price Transparency and No Surprise Bill rules.

If you’re a company working in space or just want to pontificate—please reach out—kahini [at] obviousventures [dot] com.